Old Chevelles

Welcome to OldChevelles.com, built by Auto Enthusiasts for Auto Enthusiasts. Cars are not our only interests so please feel free to post about any subject the community might enjoy or you just feel you need to air.

We respect free speech and constructive dialogue however we don't allow threatening talk against members, nudity, or pornography. Threads are monitored and trolls are not tolerated.

This site is completely free and there are no costs. Please enjoy and provide feedback.You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

How Much Did You Pay For Your 1st House?

- Thread starter Chevelle_Nut

- Start date

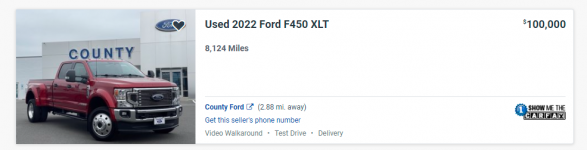

72k in '90, 9% loan, $950 payment (15 yr.). That truck @ 3.5% and 84 month loan is $1334. Can't justify that, but I aint Elon.

2005, 130K I put down 80K & paid off the rest in about 10 years.

Kawickrice

Well-Known Member

1988 Built a Jim Walters sweat equity house for $40,000 plus a lot of hours of sweat.

1978 bought a 72 built masonry 3 bed, 1 bath, 1 car gar. in Pinellas Park Fl. a little over $26K., my wife bought the house we're in now in 87 2 bedrm, 1 bath, detached 1.5 car gar. $46K, A USED TRUCK at that! LOL wonder why they didn't throw the name SUPER DUTY in the ad ?...A few times

Built new 3br 2bath home in Sarasota, FL....refinanced the lot we had bought and the total cost was $38,000. House is worth $400,000+ today!

kmakar

Janitor

How many houses have you bought and lived in?

I've had a number of houses I bought as rentals, but we've only bought 6 houses (to date) that we bought and lived in.

I refer to them as houses because in my view wherever you live you make it a home. A house to me is just a piece of real estate (although most women become emotionally attached to them for some reason).

I've had a number of houses I bought as rentals, but we've only bought 6 houses (to date) that we bought and lived in.

I refer to them as houses because in my view wherever you live you make it a home. A house to me is just a piece of real estate (although most women become emotionally attached to them for some reason).

Derek69SS

Veteran Member

I'm only on my 2nd...

Bought my first in 2003 for $126k

Lost my ass on it when I sold in fall of 2011 at the bottom of the market for around $90k

Bought my current house (also at the bottom of the market) for $310k in spring of 2012. Worth about 500k now.

Thinking of buying some commercial real estate as an investment/rental property soon... Going to look at one later this week. Might be too much of a money-pit though.

Bought my first in 2003 for $126k

Lost my ass on it when I sold in fall of 2011 at the bottom of the market for around $90k

Bought my current house (also at the bottom of the market) for $310k in spring of 2012. Worth about 500k now.

Thinking of buying some commercial real estate as an investment/rental property soon... Going to look at one later this week. Might be too much of a money-pit though.

Since married we’ve had 6 places, 1 apt, 1 mobile home (while I was in college), 1 rented house, 1 rented condo, & 2 houses. We’ve been in our home in PA for going on 35 years (wow how time flies!). Of course we totally rebuilt our house after our fire in 2008, so in my total that should count as 2 houses! Ha! This is one reason where moving is so tough....we sunk a lot of money into the rebuild (custom kitchen, $$ Anderson windows, etc).

Chevelle_Nut

Shop Foreman

On our 2nd. We have been in it 16 years and I can see us being there for many more years. It is on family land given to us by Lisa's parents and FIL still lives next door. I made a promise to her Mama years ago I would not move her baby away from her. Her Mama is gone now but her Dad needs us to be nearby. I wouldn't have it any other way.

Market is beyond crazy here which begs the question.....anyone have ideas to dance around the $250k limit on appreciation tax? I'm single, and have over $400k in appreciative value but only 40k or so in documented expenses. Shop is probably valued at $125k but most of that I built on favors and bartered materials which I have no receipts. I'm going to get hammered when I sell....which is why I feel glued here.

kmakar

Janitor

Market is beyond crazy here which begs the question.....anyone have ideas to dance around the $250k limit on appreciation tax? I'm single, and have over $400k in appreciative value but only 40k or so in documented expenses. Shop is probably valued at $125k but most of that I built on favors and bartered materials which I have no receipts. I'm going to get hammered when I sell....which is why I feel glued here.

:max_bytes(150000):strip_icc()/153221908-5bfc2b8c4cedfd0026c118f2.jpg)

Capital Gains Tax on Home Sales

Capital gains taxes on real estate and property can be reduced when you sell your home, up to certain tax limits, if you meet the requirements.

We'll be putting our house up for sale within the next 2 months so we can travel the country, and when we get back we'll buy more land and build another place, but we are under the appreciation tax rule because we're married. We built the house in 2017 for 185k, and it's worth almost 500k now, so based on the rule 500k - 185k = 342k, but if I were single, I'd be paying taxes on 92k, BUT, depending on your income that will set your tax rate. The included article explains most of it.